SILVER Nível visado: 26.9730

Aproximando-Apoiar nível de 26.9730 identificado em 07-mai-2024 10:00 UTC

SILVER Nível visado: 27.4520

Aproximando-Resistência nível de 27.4520 identificado em 06-mai-2024 06:00 UTC

GOLD – Continuation Padrão gráfico – Cunha descendente

Um Cunha descendente emergente foi detectado em GOLD no gráfico 4 hora. Há um possível movimento em direção ao 2273.8916 nas próximas velas. Uma vez atingindo resistance, pode continuar sua tendência bearish ou reverter para os níveis atuais de preço.

SILVER Nível visado: 27.0835

Canal descendente quebrou na linha de resistência em 03-mai-2024 05:00 UTC. Possível previsão de movimento em alta nos próximos 23 horas para 27.0835

GOLD – Reversal Padrão gráfico – Cunha descendente

Um Cunha descendente emergente foi detectado em GOLD no gráfico 4 hora. Há um possível movimento em direção ao 2275.4018 nas próximas velas. Uma vez atingindo resistance, pode continuar sua tendência bearish ou reverter para os níveis atuais de preço.

SILVER Nível visado: 26.3400

Aproximando-Apoiar nível de 26.3400 identificado em 02-mai-2024 03:30 UTC

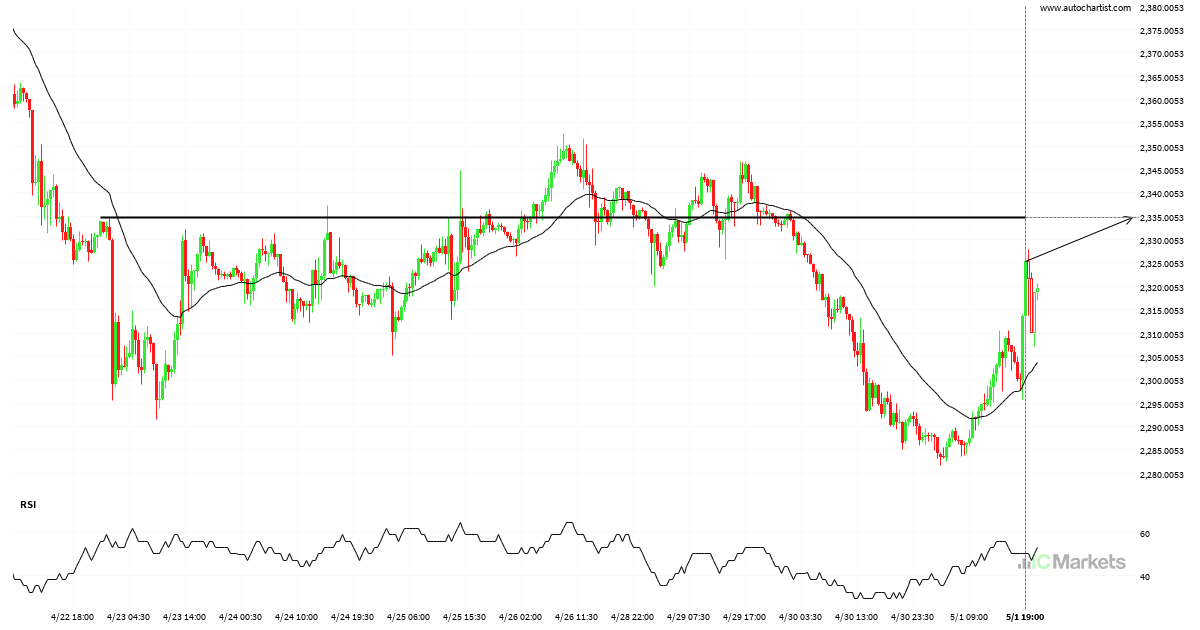

GOLD Nível visado: 2334.7800

Aproximando-Resistência nível de 2334.7800 identificado em 01-mai-2024 19:00 UTC

SILVER Nível visado: 26.6858

Cabeça e Ombros quebrou na linha de suporte em 30-abr-2024 05:00 UTC. Possível previsão de movimento em baixa nos próximos dia para 26.6858

GOLD – Continuation Padrão gráfico – Canal ascendente

Um Canal ascendente emergente foi detectado em GOLD no gráfico 4 hora. Há um possível movimento em direção ao 2365.2532 nas próximas velas. Uma vez atingindo support, pode continuar sua tendência bullish ou reverter para os níveis atuais de preço.

SILVER Nível visado: 26.8570

Aproximando-Apoiar nível de 26.8570 identificado em 26-abr-2024 17:00 UTC